Financial Investors (Capital partners)

Reasons to invest “WITH” GeoThea

Participating in the capital of selected projects in Africa is a double opportunity for investors.

1 – Invest in “venture capital” and “development capital”

- Medium-low risk.

- High profitability and growing stability.

- Productive investments with recurring income, guaranteed by the very nature and structure of the operations in which we participate.

- Competitive energy and labor costs.

- Local markets with high demand for processed products.

- Recovery of capital in the medium term.

- Profits and short-term recurring return, either by dividend or by subordinated debt.

- Alternative exit options in the medium term (realizing capital gains) or permanence in the local economy (maintaining dividends and diversifying investment).

2 – Invest in “sustainable economy” in the “development of emerging countries”

- Exceptional returns, also contributing to global development and sustainable economy.

- Access human capital in rapid transformation (young companies).

- Regional growth higher than expected in the EU / USA / OECD and equivalent to Asia.

- Relocation of the geopolitical risk of concentrating manufacturing in a single region (Asia).

- Synergies in economic hubs conducive to investing in alternative opportunities, beyond the traditional extraction of natural resources and raw materials, with unstoppable progress towards the transformation and local manufacture of processed products with high added value.

Preferred activities and sectors

We facilitate the entry of financial investors in PPP companies or Public Administration Concessionaires, in “concrete living projects”, focused on five groups of activities, in sectors:

- Fundamental for economic and social development, which have the explicit support of the government, national entrepreneurs and the local population.

- Of high interest as recipients of profitable investments.

- Supported by technologies, management systems and integration capacity of GeoThea’s own solutions.

- Synergistic with each other and with other basic productive sectors, which allow the investment spectrum to be extended to parallel activities in the primary sectors and transformation industries in emerging economies.

- Oriented to Investors with a vocation for permanence and commitment to the host country.

We help select operations, investment volume, forms and percentages of participation adapted to the desire of each investor, according to their capacity, risk profile, profitability expectations, return terms and willingness to remain in the national economy of the host country.

Business model

- We design, develop, implement and operate Integrated Management, Information and Public Access Systems in a strategic area, within the preferred sectors.

- Our leitmotif is “the Territory”, including the resources, activities and population on it.

- Our clients are Governments and Public Administrations (national or regional), consortiums, corporations and supranational development entities.

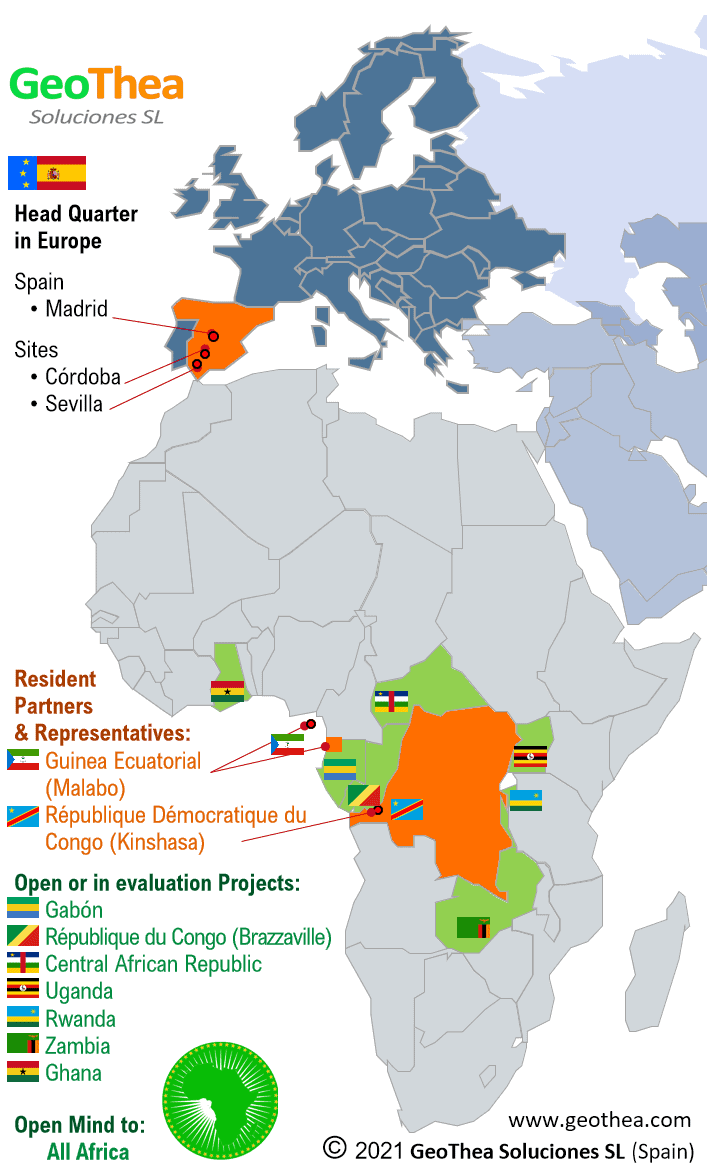

- Where? We are focused on emerging countries or those committed to the development of their resources and their population.

- The project materializes with models (PPP, BOT, BOT-EKPO *) that allow structured financing based on direct returns, guaranteed by a specific and finalist regulation, with escrow flows operated by regional banks.

- The “corporate and operational vehicle” (“SPV” *) is a “national company, under private law, specific for the tasks of a specific Project, case by case, with mostly private, local and international financial and technological partners”.

- At the end of the contractual term and possible extensions, the “SPV” reverts fully operational to the contracting Government or Public Administration (including its assets, obligations and highly trained national personnel), once the payment conditions for supplies, services, amortizations and other contract considerations to private partners.

[*]

PPP Public Private Partnership

BOT Building Operation & Transfer

EKPO Evolving Knowledge Process Outsourcing

[**]

SPV Special Porpouse Vehicle (Specific Purpose Vehicle)

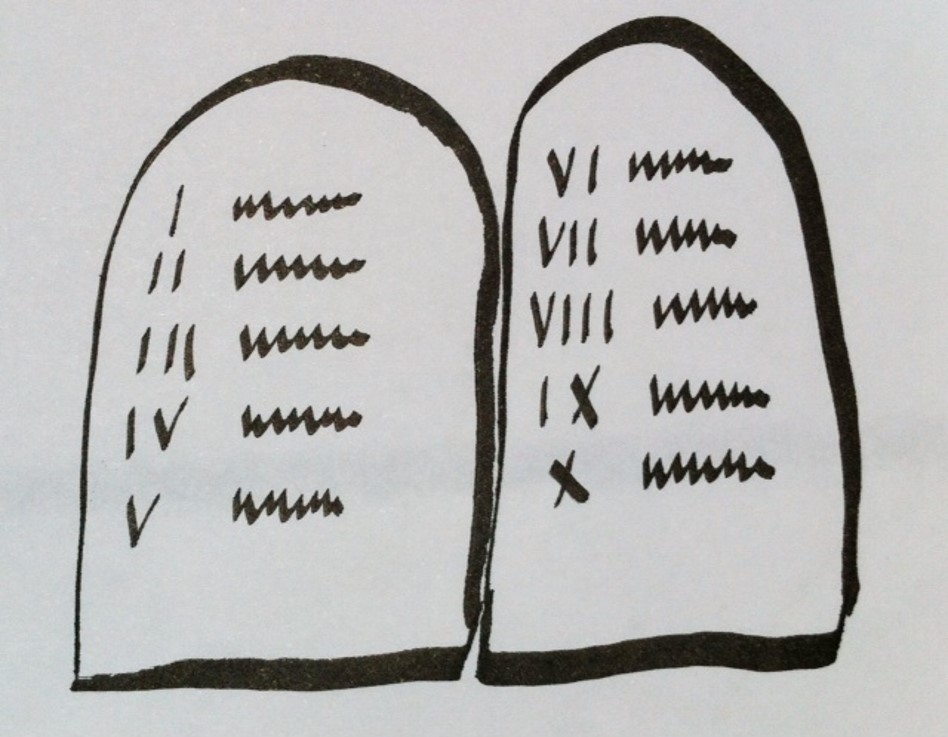

Decalogue of investment opportunities: Why they are preferred SECTORS

I. The know-how and key technologies are our own, and we have the capacity to integrate into open technological and operational ecosystems.

II. They offer investment synergies in underlying strategic sectors (agriculture, food, industrial development and services, tourism, information technology, software manufacturing, regional services…)

III. They produce short-term monetary returns (to the State and to the Operator), recurrent and growing: their structured self-financing is viable.

IV. They generate retail banking business for local and regional entities (collection of fees, rates, etc., and escrow flows).

V. They create a business fabric with high added value, with the creation of Joint-Ventures with local businessmen and entrepreneurs and, therefore, they promote a favorable state of opinion in local lobbies.

VI. Private Exploitation, Concession, PPP (Public Private Participation) and BOT (Building Operation & Transfer). They facilitate structured financing without resorting to sovereign guarantees: they can be set up very quickly and management is transparent.

VII. They are consistent and convergent with the SDGs (17 Sustainable Development Goals of the United Nations for the 2030 Agenda) [http://www.un.org/es/], which are the obligatory “reference guide” for emerging countries or in clear development. They promote and are integrated into the circular economy.

VIII. They offer benefits and public services that the Population wants and demands from their Governments, with which they have a base of social support: they generate quality employment and decent wages at the top level of the local market, improving living standards in general.

IX. In addition to being sustainable…, they are “visible” to the international community (transnational organizations, foreign investors, producers seeking relocation alternatives from developed countries, and which, at the same time, are opportunities for “relocation” in the host countries).

X. They enhance national capacities and technological and operational independence from third parties, by relying on technology and knowledge transfers, qualifying local staff for each project, which allows long-term sustainability and independence.

Investment Synergies in Productive Sectors (public, private or mixed)

GeoThea’s core-business is to DIRECTLY provide technology, services and support to local operations

Our knowledge of the Projects, the confidence generated in the decision makers and Authorities, together with our interest in the rapid realization, profitability and economic returns, moves us to be “facilitators” to obtain additional financing that promotes the Projects of which we are suppliers of technology and services, through our Corporate Partners (see).

Private sector

- Participation with optimal Local Entrepreneurs, selected by our Corporate Partners

- Direct investment (“risk & development capital”) in private service entities, which promote and operate different projects

- The Projects in which we mediate with investors through our Corporate Partners are always related to GeoThea’s know-how and projects in which we are involved in the supply of technologies

- 100% private management, focused on results and economic benefits

PUBLIC or MIXED sector

- Companies with specific dedication to specific projects, participating in the capital and in the corporate governance bodies of Joint Ventures that include committed local partners and National or Regional Agencies.

- Concessionaire entities at the service of the Public Administration that carry out local operations

- Subject to “private law” and participatory management, minority of the State

- Private partners protected by “call and put options” systems and “escrow” guarantees.

- Context of legal guarantees

Profiles

- Individual investors

- Funds oriented to the creation of high value in the medium term, with a vocation for permanence or for realizing capital gains.

- Individually or collectively, people committed to sustainable development and who firmly believe in being part of a better future, taking some risks and working for it.